My personal finance perspective is this: It’s actually my duty as a gay man to live a fabulous, fulfilling life.

I say this with both sassiness and reverence. Throughout the ages, LGBTQ+ folks have been marginalized and criminalized, demeaned and devalued. Generations of people died in either infamy or in the closet, their loves and identities hidden from the pages of history. Channeling wealth and fabulosity, as epitomized in 1980s ballroom culture, is a means of pushing back against a society seeking to silence and erase us. When Junior LaBeija declared “Opulence: You own everything!” in Paris Is Burning, it became a rallying cry to show up loud and proud.

Being extra is queer expression at its best, but this excess is looked down upon in personal finance circles. And as a money columnist, I think that’s too bad. Queer people sometimes get panned as fiscally irresponsible, when in reality we have more challenges to overcome because of career and personal discrimination. We earn 10 percent less than non-LGBTQ+ people, are twice as likely to report having a poor or very poor credit score, and carry an average of $16,000 more in student loans. The COVID-19 pandemic also exacerbated money obstacles; queer people had higher incidences of poverty and food insecurity in 2020, according to the Williams Institute at UCLA.

Additionally, long-standing career discrimination has stunted LGBTQ+ earning potential. Equality in the workplace notched a win with Bostock v. Clayton County, which found that the sex discrimination clause of the Civil Rights Act does apply to sexual orientation and gender identity. But that decision was in, uh… *checks notes*... 2020. Translation: People have been getting fired for being LGBTQ+ for years. In the face of ongoing bigotry and discrimination, LGBTQ+ folks must do better with both saving and making that money so we can live our most fabulous lives. Use one or more of these tips to recenter your efforts.

@nickwolny1 Has being extra become a non-negotiable expesne for you? #lgbtq🏳️🌈 #lgbt #lgbtq #gaytiktok #lgbtqtiktok #lgbtqtravel #journalist #journalism #finance #personalfinance #loudbudgeting ♬ original sound - Nick Wolny | Editor

No. 1: Release Old Money Thoughts

To pay homage to generations before mine, I’m going to do the work and live my best life as a gay man. Part of that work means adjusting my thoughts and beliefs around money to both achieve my goals for the future and live a very homosexual present. For many of us, our wealth journey begins with unraveling some of what we learned about money in our youth.

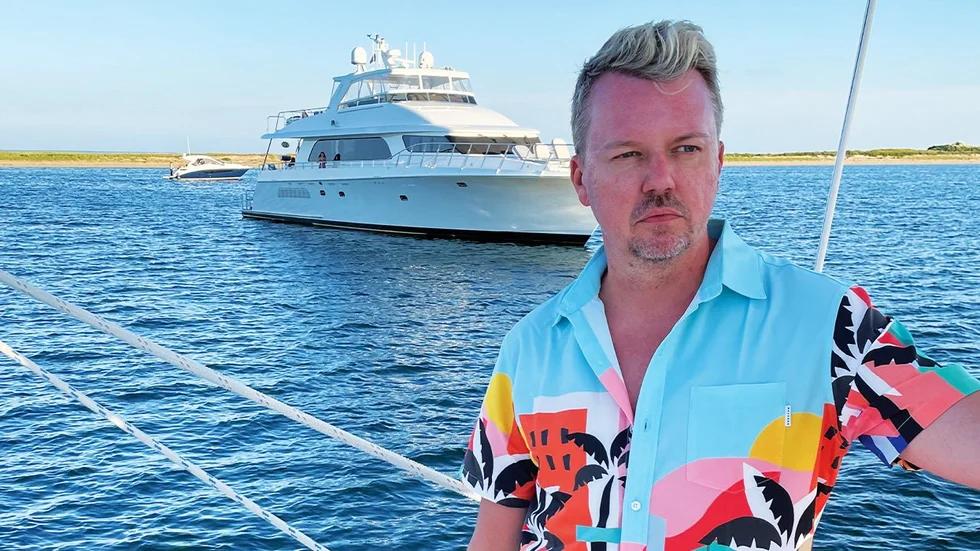

“Growing up, my family bounced from one financial crisis to another,” says Doug Champion (pictured), an entertainment executive living in Denver and Palm Springs. “I always had to let the answering machine pick up the call, because it might be a bill collector calling for one of the many maxed-out credit cards that bridged the gap at the end of the month. I carried that generational money trauma into my early 20s, where I was worried about the amount of every individual purchase.”

For Champion and many others, living loud is a way to reject and leave behind the years in the closet, of not showing up as your true self. “I was anxious about having too much attention paid to me, because scrutiny might lead to discovery of my gayness. Now as an out and successful gay man in my mid-40s, the pendulum has swung in the other direction,” he says. “I will confidently take up space, loud, and proud.”

No. 2: Death Drop the Basics

That means making more money, lowering expenses, and investing the difference, both in your current and future self. You can’t pursue your dreams without the necessary support. If that means adding a side hustle or changing jobs to get the necessary financial resources, do it. And don’t worry, making extra prize money doesn’t only have to be snatching trophies with a savage death drop; you could sell a service, create a product, or pick up some gig work to close the gap instead.

Stack that cash, but also don’t budget so tightly that you’re miserable. “I went through a brief period where I was tracking everything in an Excel model, and not only did that level of diligence not lead me to wild dynastic wealth, it just stressed me out,” says Champion. Find what makes you feel fabulous and have it in your life so you can keep your fire burning bright.

No. 3: Ask the Hard Questions

We don’t latté-shame in this column because lattés are delicious but also because small-budget trims don’t add up to much progress. Ask yourself hard questions and have crucial conversations with your loved ones. Is the city you’re living in really working for you? Does your career have growth potential — and does it still light you up?

If the answer to any of those questions is no, take a deep breath, then do or say the hard thing that will steer you in the right direction.

No. 4: Ignore the Haters

If you’re worried that your friends will judge you for driving Lyft on the weekends or starting a YouTube channel to make extra money, get new friends. Seriously. Instead of looking good for your gaggle and then hyperventilating when you read your credit card statement, cultivate a stable life that gives you direction and peace. You’ll be more naturally confident too, and confidence has a sexiness that simply cannot be bought.

The best is still ahead of you. But to get there, you’ll need to drum up resources. Ride the energy of the new year to make necessary changes, and you’ll soon be living a life that would make our queer ancestors proud. ◆