There I was, staring at my screen on a Friday night, about to tear my hair out.

"Why didn’t they buy? What step did I miss? Should I give up?"

I had just launched a program to my then-tiny email list, followed up with dozens of contacts individually, and still seen poor sales results. Was my offer wrong? Was the audience for my offer wrong? Was the way I wrote about my offer wrong?

The truth turned out to be none of these. Reader feedback helped me discover years ago that, by launching two different offers three weeks apart from one another, I had made a rookie mistake and created confusion. The main reason people didn’t buy my program was simply that they thought it was the same offer as a mini-course I had pitched three weeks earlier.

Important:Getting feedback on how users perceived your offer helps you figure out what to adjust next in your messaging and marketing.

I never would have known any of this — and would have remained in my head for weeks or months to come — had I not sent out a non-buyer survey. A non-buyer survey goes out to readers immediately after the cart closes for your launch, and its results will give you clarity and direction on what to do next in your messaging efforts.

Here's what a non-buyer survey is, and why you should start sending one today.

What Is a Non-Buyer Survey, Anyway?

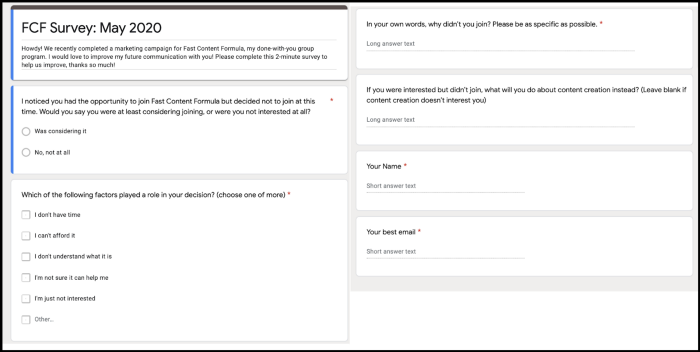

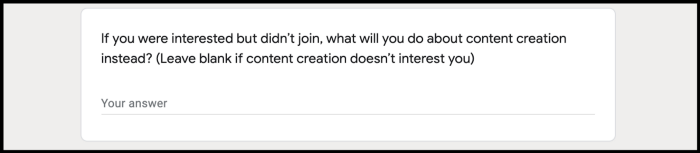

A non-buyer survey is a short questionnaire — usually three to five questions total — that you send to leads who didn't sign up for your offer. It’s short and takes just a few minutes to complete. Here’s what my entire non-buyer survey looks like, front-to-back, and I use the same one every time.

The survey is sent immediately after your sales cycle closes — within 48 hours of cart close is best — to capture feedback, while your offer is still fresh in your prospect’s mind.

Selling via email: effective, but a long game

The industry standard conversion rate for an email marketing-based launch is 0.5-1%. That’s right: If you take all the right steps, attract and build a list of 1,000 subscribers, then sell something to them, having 5 subscribers sign up to buy (0.5% of 1,000) would be considered a success.

Monetizing an email list takes time. But what many writers and entrepreneurs gloss over about a list is that email subscribers are willing to give you real-time feedback. Leverage that help!

Core Questions of a Non-Buyer Survey

Since I email my list a lot in the final days of a sales period, I make the survey email really short.

Here is my exact script — this is the entire email.

SUBJECT: Can I get your feedback, <NAME>?

Hi <NAME> -

We just finished up promoting <YOUR OFFER> -- and I noticed you didn’t sign up.

Would you consider filling out this five-question survey?

I want to ensure I am improving my communication with you moving forward and your feedback will really help.

<SURVEY LINK>

Thanks!

It’s clear, it’s to the point, and it actually gets a pretty good response rate when I send it soon after the end of the sales promotion.

My survey then consists of the following five questions.

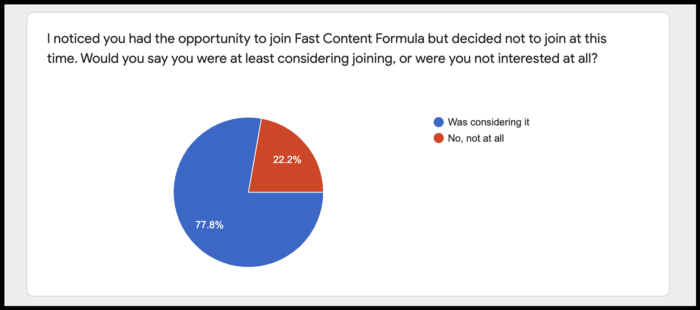

"Were You Considering This Offer, or Not Considering It At All?"

Right out of the gate, this question will help you figure out if your offer was compelling enough to your readers.

This is why it's important to attract relevant subscribers to your email list.

Important:When it comes to email lists, relevance is more important than size.

If people join your list for daily horoscopes, and then you try to hit them with a workshop about stocks and bonds, this question will clearly expose the dissonance in your offer.

In my underperforming launch, I did discern that those who observed the launch and didn’t buy were at least thinking about the offer.

There are many survey options out there. I choose Google Forms because you can accept unlimited responses for free.

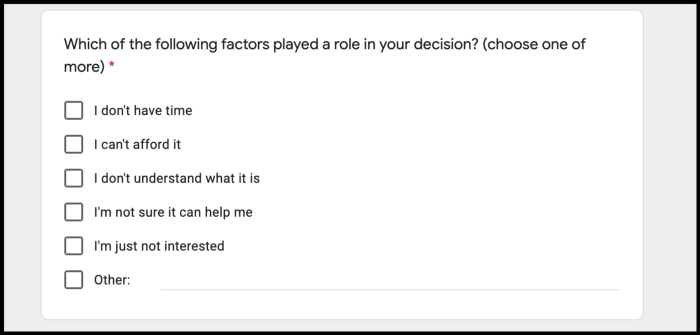

"Which of the Following Factors Played a Role in Your Decision Not to Buy?"

I let my survey responders check as many of these boxes as they want, and I also like to offer an “Other” category. The responses I include are:

- I don’t have time.

- I can’t afford it.

- I’m not sure it can help me.

- I don’t understand what it is.

- I’m just not interested.

The first three reasons will get the lion's share of feedback — these are typically the top three objections in sales in general.

If you have a lot of subscribers saying they didn't understand what the offer was, that's a positioning problem. You either need more content marketing to educate readers prior to promotions, or you need to clean up the way you describe your offer and its benefits.

If you have a lot of subscribers saying they were just not interested, be alert. Your list may have a lot of dead weight or people who will never buy. Consider shifting your focus to attracting more readers who would actually want to buy.

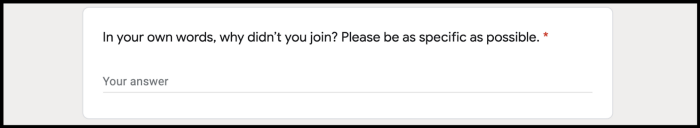

"In Your Own Words, Why Didn't You Buy? Please Be Specific as Possible."

This is by far the most valuable question of the survey. It is the question in which respondents will give you the exact reasons they did not hand over their money to you and what you need to fix in your offer to make it better convert. I love this question!

Even though feedback stings, these responses will give you direction and insight from a very valuable audience. Remember, these are the subscribers who are interested enough to respond to a survey — they are in the bottom of your sales funnel.

"What Will You Do Instead?"

This question is also very strategic.

You can use the responses to this question to potentially learn about competitors or other solutions that are in your market. You'll also discover the escape hatch that users said to themselves to object to your sales pitch.

What I also love about this question is that it forces the non-buyer to think about their problem and how it’s still not solved. This twists the knife a bit and can potentially set you up for sales in the future

"May We Contact You for Research Purposes Down the Line?"

This question is optional, but I prefer to ask it. If you make contact information optional, you’ll probably get more total responses, since your survey takers can remain anonymous. Yu also may get more trolling responses.

These survey takers, especially ones who give detailed or interesting feedback, are perfect candidates for you to do informational interviews and research with at a later date. It’s a great customer service play, because you’ll give them some personalized attention, and you’ll get awesome customer insights that can help you make your next move. It’s all about momentum!

Never let yourself remain in the dark on your next messaging moves. Ask for more feedback than you think you should, figure out what works and what doesn’t, and keep your momentum up.

When you have feedback loops in your business efforts, you’ll always know what action step to take next. 👋🏼

Thanks for Reading 🙏🏼

Keep up the momentum with one or more of these next steps:

📣 Share this post with your network or a friend. Sharing helps spread the word, and posts are formatted to be both easy to read and easy to curate – you'll look savvy and informed.

📲 Hang out with me on another platform. I'm active on Medium, Instagram, and LinkedIn – if you're on any of those, say hello.

📬 Sign up for my free email list. This is where my best, most exclusive and most valuable content gets published. Use any of the signup boxes on the site.

🏕 Up your writing game: Camp Wordsmith® is a free online resources portal all about writing and media. Get instant access to resources and templates guaranteed to make your marketing hustle faster, better, easier, and more fun. Sign up for free here.

📊 Hire me for consulting. I provide 1-on-1 consultations through my company, Hefty Media Group. We're a certified diversity supplier with the National Gay & Lesbian Chamber of Commerce. Learn more here.