THANK YOU for reading Money Proud! Welcome to my digital home (gestures to website). Kick your shoes off. Would you like a blanket? A water? An espresso or a tea?

Here are a few extra goodies and updates exclusively for Money Proud readers.

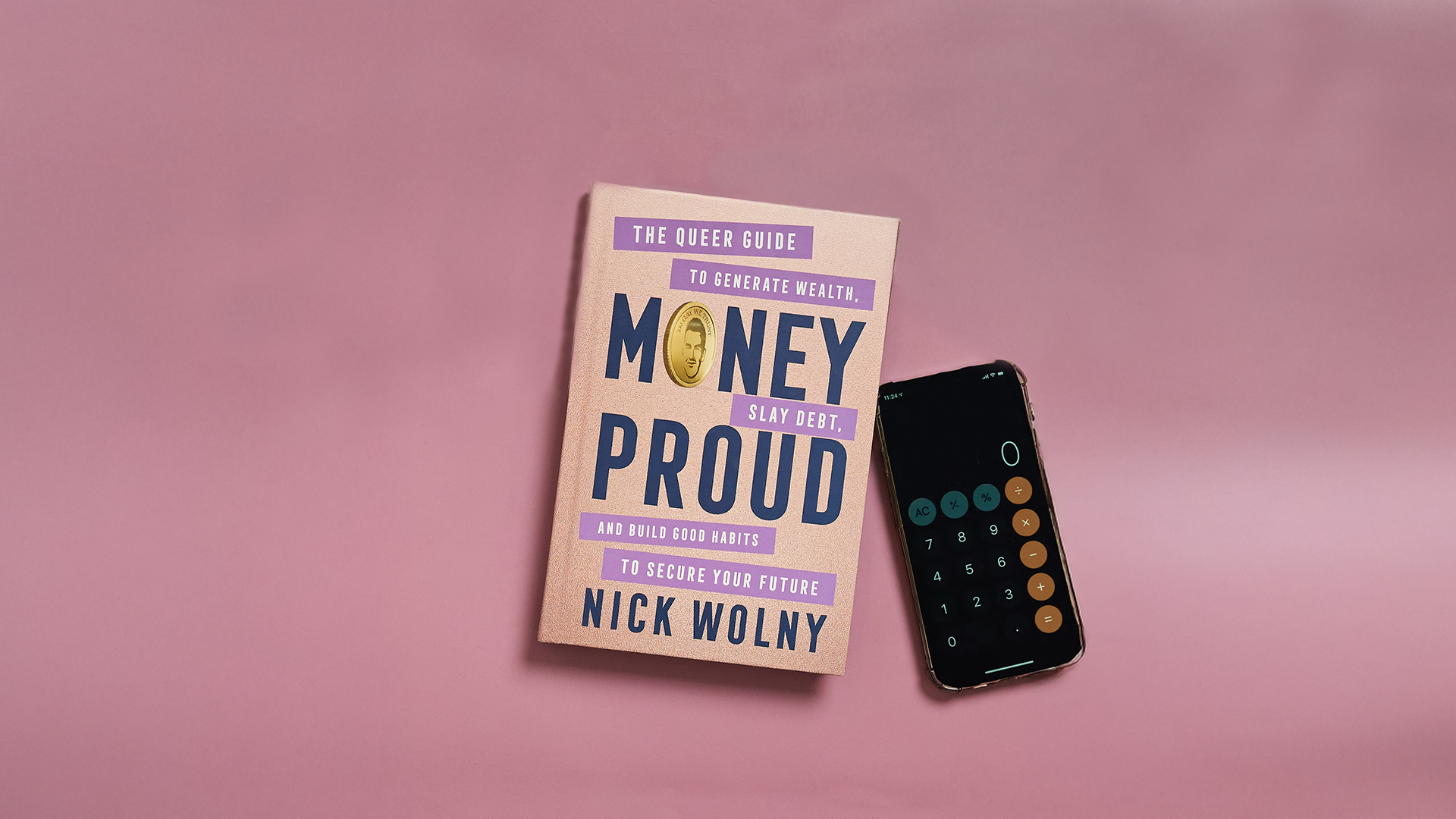

Glossary download

Dump truck problems, am I right? This book’s ass was simply too juicy for the glossary to fit into the 320-page cap. Whoops!

Here it is as a digital download instead. Keep this glossary handy in case you ever want to reference terms and concepts introduced in the book.

Money Proud Glossary

A nifty lil’ PDF of definitions for 112 money terms, written in the style of Money Proud.

Money Proud: The Course

Would you like to go deeper on the concepts—and have one nifty little dashboard that lets you implement the exercises all in one place?

If the answer is yes, you might be interested in Money Proud: The Course, releasing in early Spring 2026! Here’s a sneak peek video.

Sign up for my newsletter below and check the waitlist checkbox to indicate your interest, and I’ll send you details.

If you're already on my newsletter, you can opt into this waitlist in the pre-footer callout of any issue from 2026 onward.

We're thousands strong, we like to read, and we've broken free from algorithms completely controlling what we do and don't see—join us.

Let’s keep in touch

My newsletter Financialicious is the best way to keep in touch. God knows what these algorithms might do to queer content soon.

If you’re hanging out elsewhere on the internet, though, I’d love to connect and be in your orbit. Add me now before it slips your mind and I’ll keep serving up hot, snappy finance takes to keep you in the know.

@nickwolny1 Queer ppl, income, and how language changes what shows up. Original data set is the NSDUH survey from 2015-2021, which had about 68,000 respondents each year. There wasn’t a statistically significant income difference for heterosexual women reporting some SSA vs no SSA. #lgbtq #mlm #gay #personalfinance #queer ♬ original sound - Nick Wolny ✍🏼🏳️🌈

Alright, previews complete. If you’re gonna open that loud-ass package of Twizzlers during the movie, maybe just do it now.

Here are some additional Money Proud resources, organized by chapter.

Table of Contents

Chapter 1: Thought Patterns

1.1: Calculating taxes on independent contractor income

It's important to set aside some of your side hustle or freelance money for taxes.

A short answer is that, if you're making less than $150,000 a year, and some of that money was independent contractor income, setting aside 20 percent of that money for taxes should be sufficient. (This isn't 100% accurate, but it's usually conservative enough and will leave you with buffer. It's also easy to do in your head—lop the last digit off your payment, double it, and that's 20 percent.)

The longer answer is that the amount of taxes you'll owe on freelance work or gig work depends on how much money you made in a given year because the U.S. uses marginal tax brackets. We touch on marginal tax rates more in chapter 7.

This question gets asked a lot, so there are some online calculators that will help. I like this one from TaxAct.

1.2: Online budgeting app recommendations

A budgeting app will make your life so much easier. I personally use Rocket Money because it has a smooth app experience. You can learn more about them here (not an affiliate link). Other popular options include You Need A Budget (YNAB) and Monarch Money.

Budget App Recommendations

Here are a couple roundups from my media colleagues I recommend.

Lifehacker's best budgeting apps

Chapter 2: Debt

2.1: Debt payoff calculators

A debt payoff calculator can help you set timelines for your debt payoff.

Calculator.net has a nice calculator that lets you line up your debts according to the avalanche method.

There's also this calculator from Charles Schwab, which lets you chose avalanche method or snowball method from the jump.

Chapter 3: Saving Rate

3.1: Compound interest playtime

Use this calculator to tinker with compound interest projections.

3.2: High-yield savings accounts

In this chapter, we talked about high-yield savings accounts (HYSAs). Many of the best HYSAs are online. Here's a roundup from my CNET colleagues I recommend.

CNET's best high-yield savings accounts

3.3: Saving rate formal definition

As discussed, the Bureau of Economic Analysis' definition of saving rate is disposable income contributed specifically to savings and investments. The Federal Reserve of St. Louis tracks this number, and you can see and play with that here.

I like modified saving rate, which we discuss in Money Proud, because it counts the money you're allocating to additional debt paydown. If you were in a pinch, you could reallocate that money as needed.

Tip:Saving rate is savings and investments as a percentage of disposable income. Modified saving rate is similar to saving rate, but also counts any additional debt paydown you're making.

Chapter 4: Budgeting

4.1: Budgeting app recommendation that allows sinking funds

If you haven't set up an online budgeting app by this point in the book, I recommend you do so. You can use the recommendations in the Chapter 1 section above.

One callout I have is that Ally Bank offers a feature called savings buckets. This is great for sinking funds and keeping yourself organized if you want to incrementally save money toward different goals that have different timelines.

Here's a post from Ally Bank describing that feature in more detail.

Chapter 5: Income

5.1: Side hustle ideas

Back when I was an editor at NextAdvisor, we had a side hustles roundup that was killing it... before the site was taken offline. 😭

Fortunately, you can still get to it using the Internet Archive. If you can tolerate long load times, here's a great megablog we did of 25+ side hustles.

26 Side Hustles That Will Make You Money

Chapter 6: Investing

6.1: Retirement account contribution limits

Retirement account contribution limits may increase from year to year to keep pace with inflation. You can find the most updated contribution limits on the IRS' website.

Press release on the updated numbers for 2025

Chapter 7: Taxes

7.1: Marginal tax rates

Marginal tax brackets change every year. This is due to inflation, but might also be due to new legislation or updates to the United States tax code.

You can always go to the IRS' webpage on marginal tax rates to get the most updated information. That webpage is here.

Chapter 8: Entrepreneurship

8.1: Bookkeeper recommendations

A good bookkeeper or bookkeeping software can help you keep your act together. I used Bench for several years, but no longer recommend them. Now I use Quickbooks.

Here are some roundups from my media colleagues to check out.

PCMag's best bookkeeping software for small businesses

Mashable's best bookkeeping software for small businesses

Chapter 9: Financial Independence

9.1: Recommended reading from yours truly

This website has some good blogs on FIRE if you'd like to read up about it. Here are some current articles to read to get yourself started.

9.2: FIRE number calculation

Here's a little interactive embed to let you calculate your own FIRE number.

9.3: CoastFI number calculation

Here's another embed that will let you calculate your CoastFI number. Remember, CoastFI is a lower number on the path to FIRE at which, if you were to stop contributing your investments, your investments would compound the rest of the way to your goal, given your expected annual rates of return.

Chapter 10: Legacy Planning

10.1: Estate planning service recommendation

If you want some help getting your estate planning materials in check, I recommend Trust & Will (aff link). I used them personally to create my will and trust, and the above link will get you 25% off your order as of this writing.